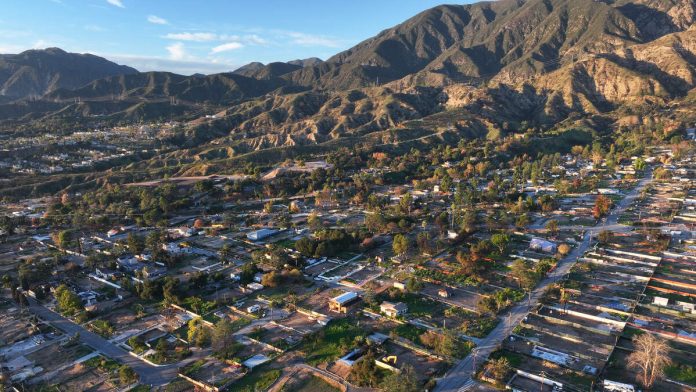

In the aftermath of the devastating Eaton Fire, which ravaged thousands of homes in and around Altadena, a significant portion of vacant lots in Los Angeles County burn zones are being purchased by investors.

According to a recent report by Redfin, investors acquired approximately 40% of the land sold in areas affected by the January 2025 California wildfires. The report, published on Tuesday, reveals that in the third quarter of 2025, investors bought 48 of the 119 lots in Pacific Palisades, 27 of the 61 lots in Altadena, and 19 of the 43 lots in Malibu.

The trend of investor purchases is particularly notable in Altadena, where nearly half of the vacant lots were sold to investors. Many of these lots previously had homes that were destroyed in the fires. Redfin Premier real estate agent Sylva Khayalian noted that some residents are selling because they lack the financial resources to rebuild, while others are elderly or were underinsured. Khayalian stated, “People who plan to stay are encouraging others not to sell because of how much it could change the neighborhood—but for some residents, selling is the only option that makes financial sense.”

In contrast, Pacific Palisades, a more affluent area, has seen some homeowners purchase new homes while deciding whether to rebuild. The average household income in Pacific Palisades is nearly $400,000, more than double that of Altadena. Redfin Premier agent Justin Vold mentioned that as insurance coverage for temporary rentals ends, more buyers are expected to enter the market, potentially increasing the number of vacant lots for sale.

The report highlights that while investor activity is high, there is an abundance of land for sale, with many lots remaining unsold. In Pacific Palisades, 309 lot listings were recorded in the three months ending November 30, compared to just seven a year earlier. Similarly, Altadena saw 225 lot listings, up from two, and Malibu had 214, up from 125. As more residents decide against rebuilding, the pileup of vacant lots is expected to grow.

Recent Comments